At some point, you must have encountered a situation where a client doesn’t pay on time, refusing to pay altogether, or can’t afford to pay the full amount for services rendered. While each of these situations is notably frustrating, it’s important that you respond in the appropriate manner. How you respond will not only impact your chances of collecting on the debt, but it’ll also reflect on your brand image.

Here are 6 Tips For Successful Debt Collection

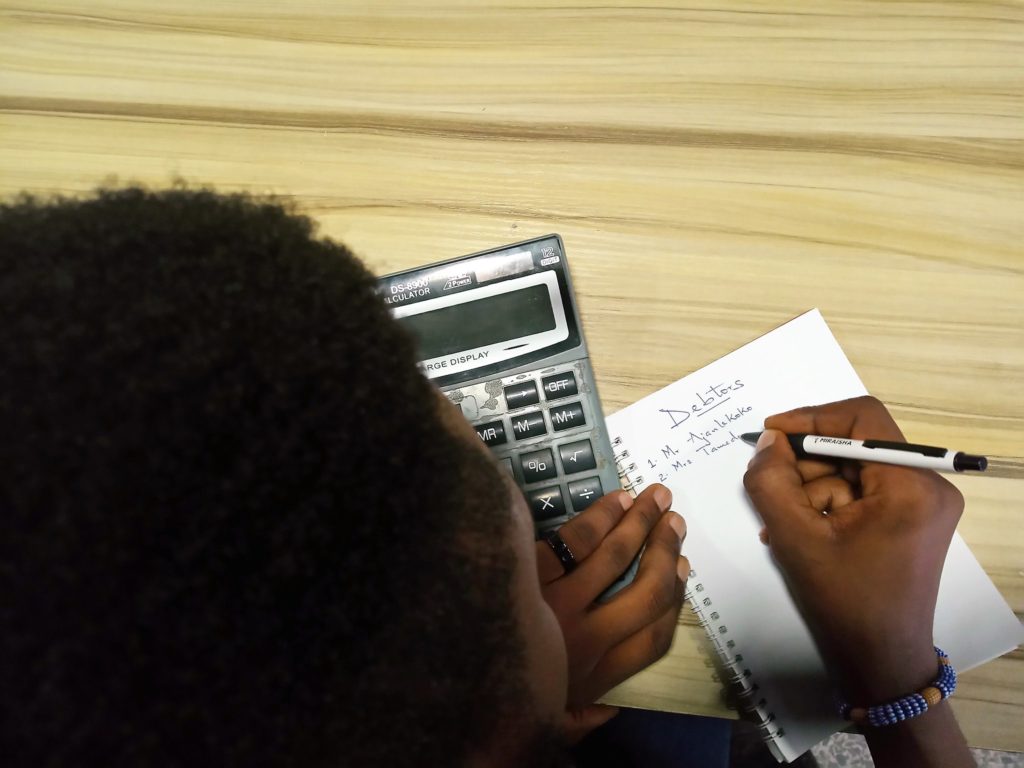

1/ Document Everything

Record phone conversations, mail threads and keep a copy of every letter you send.

Few things are as important as documentation in a small business debt collection situation. Should the debt ever lead to a legal battle in court, your ability to point to documentation will be very helpful.

2/ Avoid the urge to Harass

Harassing a customer who owes you money wouldn’t help one bit. While persistence plays an important role in collecting a debt, there’s a fine line between checking in and pestering.

Harassing looks like calling a customer every single morning for 60 straight days and screaming at them even though you aren’t. Persistence looks like calling every seven to ten days and giving the client some options by which they can start paying off the debt.

3/ Stay Calm

When you’ve provided services for or sold goods to a client and they don’t pay you on time, your tendency by default is to be infuriated (which of course you have every right to). But it’s advisable you take a deep breath and stay calm. The angrier you get, the less likely that you’ll collect on the full debt.

4/ Don’t Assume

When making your initial debt collection call, quickly make sure that the debt has in fact not been paid. Don’t alienate the customer. Remember there may be potential future business with the customer. The debt in question could be a mistake and not a collection problem at all. Be careful with your tone and your words at this point. Wait and listen to what the customer has to say, and be sure to document the interaction carefully and accurately.

5/ Hire a Collection Agency

This is especially helpful if you have a lot of outstanding debt owed to you and you’re spending a lot of time trying to collect them all. This will only not save you time and possibly allow for better results, it could keep you out of legal trouble.

6/ Offer to Settle for Less

For a client whose payment is past past the due date, and the situation is seeming like you’re never going to see the money. Before simply writing the debt off, it’s always a good idea to offer a settlement for less than you’re owed.

If you come to them and say you’re willing to take way less than they owe, they may jump at the chance to get it off their books.

You’ll never know until you ask!